You buy insurance for the what-ifs.

Auto, home, renters.

Cyber insurance is the same thing.

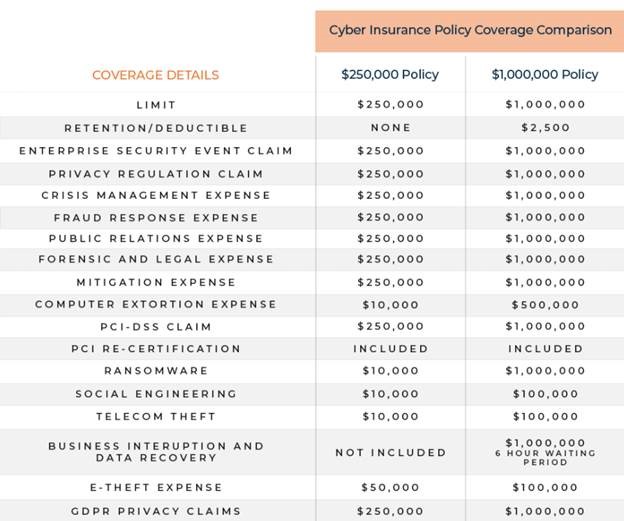

It will protect you in case of a breach and provides a widespread policy for things that you can’t even individually list or comprehend prior to a breach.

Cyber insurance is not a substitute for having strong security measures in place. While cyber insurance does cover many of the costs associated with a breach, you can’t put a price tag on your reputation.